How to Bill Accurately, Efficiently & Honestly

Photo by Austin Distel on Unsplash

Effective billing practices are essential when it comes to ensuring your law firm remains in good financial standing. For example, efficient billing can improve your cash flow and make other tasks, such as tax planning and bookkeeping, much easier to manage.

Conversely, inefficient practices could mean that you struggle to remain on top of your finances, whether that be due to poor documentation or delayed payments. As such, law firm owners must ensure they bill accurately and efficiently while remaining fair to their clients.

What billing method should law firms use?

There are many different forms of law firm billing, including:

- Hourly Rates

- Fixed Fees

- Contingency Fees

- Retainer Billing

- Or, a combination of the above.

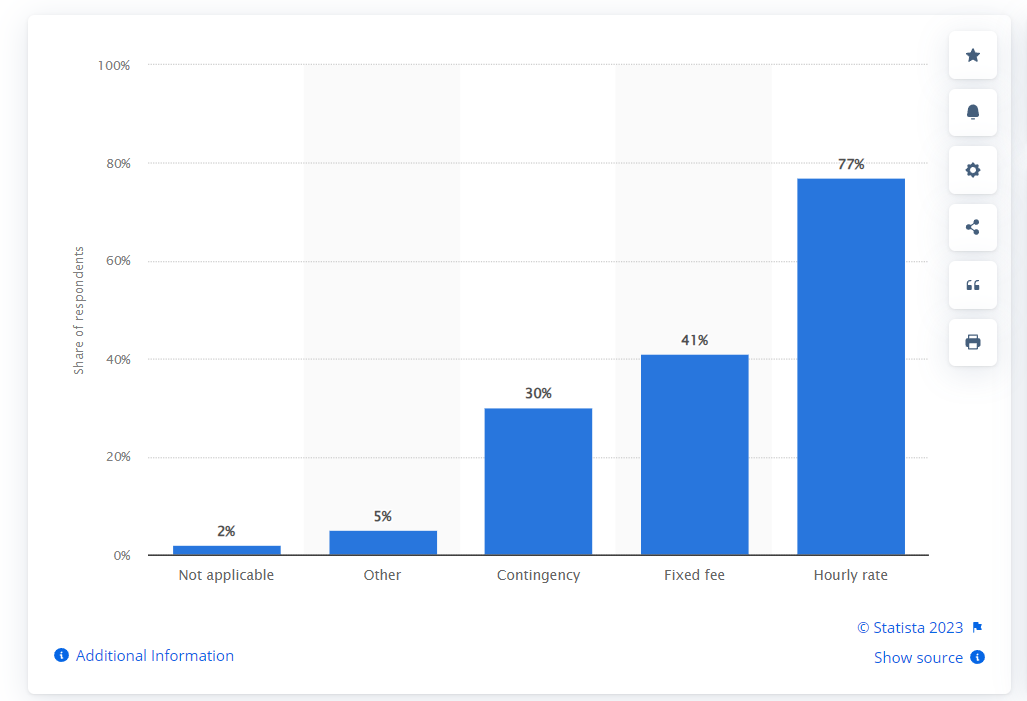

However, as evidenced in the graph below, 77% of law firms bill based upon a set hourly rate. This is often considered the most effective billing method, as it better reflects the scope of the work carried out.

Source: Statistica

What challenges do law firms face during the billing process?

Law firms encounter many problems when billing for their services.

For example, the non-payment of invoices is a major benefit for both small and large law firms, especially in the current economic climate. However, according to a recent report, “while it’s not unusual to see collections cases rise during tough economic times, the current wave of non-payments is notable not only because there are more of them, but also for the wide variety of reasons clients are finding to withhold their cash.” Therefore, law firm owners may struggle to recoup the losses of delayed or abandoned invoices.

Furthermore, many lawyers fail to properly track their time when billing based on an hourly rate. This means that the figure represented on their invoice may not accurately reflect the amount of time they’ve put into the client.

How to bill accurately and effectively while remaining fair to the client.

Discuss payments ahead of time.

One of the easiest ways to ensure your billing process runs smoothly is by discussing payment and payment schedules beforehand. This way, your clients do not feel you’ve suddenly sprung an invoice upon them without warning, and they better understand what they are being charged for. For example, instead of featuring a lump sum on the invoice, you may want to include a more detailed breakdown of the work carried out.

You should also get the agreement between yourself and your client in writing ahead of time through an Engagement Agreement or Fee Agreement.

Track your hours carefully.

Ensuring you track your hours carefully means that the invoice you send to your clients reflects the number of hours you’ve put into the case. One way you can achieve this goal is by using time management software, which carefully monitors the amount of time you spend on specific tasks or projects. Learning how to manage your time more effectively can also be useful here.

Accept many different forms of payment.

Accepting many different forms of payment, such as bank transfers, online payments, and even checks, can help to prevent delayed payments from clients. As such, it can be instrumental in improving your billing practices by removing some of the most common challenges faced by law firms.

Final Thoughts.

In short, transparency is the key to ensuring that your billing processes are efficient, accurate, and fair to clients. You need to manage their expectations ahead of time so that they’ll understand what is expected of them when you send out an invoice.

Remember, the more efficient your billing process becomes, the easier it will be to manage your law firm’s finances. However, we’re also here to assist with that task and offer a range of accounting services to our clients. Please do not hesitate to get in touch today if you’d like to hear more!